Non-cash Donations

There are different ways to be generous and better steward your resources.How Non-Cash Donations Work

Stocks & Cryptocurrency

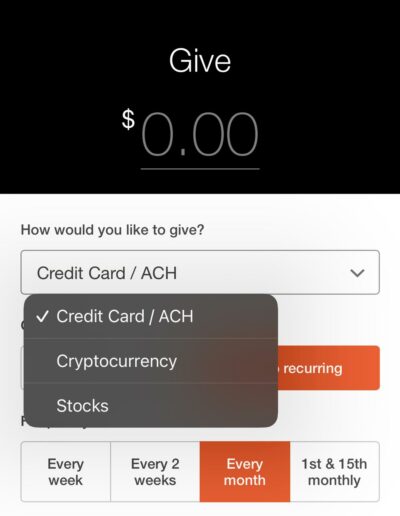

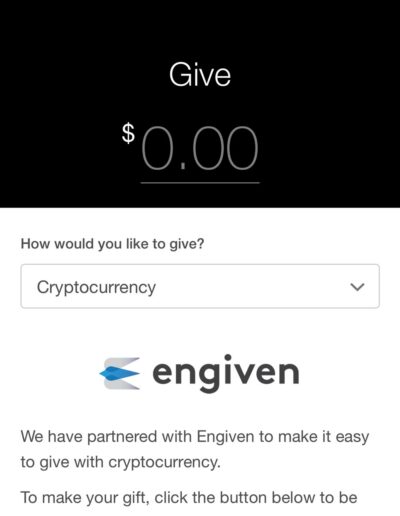

When you donate stock, you are able to avoid capital gains tax while earning a bigger tax deduction. You can also improve your personal cash flow and simplify your giving. Plus, donating stocks and crypto offers a great way to support Life Changers. By contributing Bitcoin, Ethereum, or other cryptocurrencies, you can make a positive impact while enjoying tax benefits. Crypto donations provide transparency and security, ensuring your funds reach their intended recipients efficiently. Join the digital philanthropy movement today! To donate stocks or crypto today, please visit the Pushpay App or Click Here.

Real Estate

Many property owners have a heart to give but feel hindered by limited cash flow and ever-growing taxes. If that’s you, we can help you leverage your real estate so you can send more to charity than you thought possible. Giving real estate before the sale, instead of writing checks to charity, you’ll improve your cash flow, reduce or eliminate capital gains taxes, and send more to your favorite causes. Whether you own a beachfront home or a family farm, we can help you use your valuable property to fund projects like Solar-Powered Audio Bibles, help for the poor, or anything else God is calling you to support. Click here for details.

Business Interests

If you’re running a business, our Charitable Shareholder strategy allows you to donate a non-voting interest, receive a substantial tax deduction, and still maintain management oversight. If you’re one of the select entrepreneurs who has the opportunity to sell your successful company for a sizeable gain, we can help you maximize your sale—and your impact for charity. Complete the form.

Vehicle Donation

Donating your vehicle, ATV, boat, RV, or motorcycle to charity can be a great way to invest in God’s work and receive a federal tax deduction (state income tax deductibility depends on state law). Just use the simple form below and we make the process easy and help you get the highest tax deduction for your vehicle. Complete the form.

We’re Ready to Help

Estate Planning Class

We’ll Help You…

Make a Plan

Decide whether you want money to go to the government or charities of your choice, while not decreasing gifts to heirs.

Save Money

On average, a living trust saves $2,400 to $60,000 in probate costs.

Have Peace of Mind

Rest easy knowing that your guardianship wishes for your children and distribution of your valuables are fulfilled.